Dispute management

Introduction

When processing online transactions, it is important to protect oneself against fraudulent transactions.

Our Fraud Prevention tools and the SCA guidelines are a robust solution to reduce this risk to a bare minimum. For every transaction that slips under our radar, we offer you our Dispute management service.

Let Direct help you handle fraud-related disputes by

- Getting/Processing all necessary information

- Negotiating with your acquirers

- Managing incoming/outgoing communication

- Ensuring quality assurance and eliminating PCI compliance obligations

in any given scenario/phase of an ongoing case.

On top of that, contact us to get a dedicated training enabling you to manage disputes with even more efficiency!

Use our Merchant Portal to follow-up on ongoing and past disputes.

Understand dispute scenarios

Fraud-related disputes come in various forms and phases in the online transaction processing business. We classify them by the following scenarios:

| Scenario | Description |

|---|---|

| Retrieval request (request for information) |

|

| Notification of chargeback |

|

| Chargeback |

|

| Representment (Chargeback reversal) |

|

| (Pre-) Arbitration chargeback |

|

| (Pre-) Compliance chargeback |

|

Check out the following chapter to learn the detailed dispute process for each of these and how we support you in dealing with them!

Apply best practices

The best way to deal with dispute is avoiding them altogether. Although this is not possible in all cases, with the following features, you can significantly reduce fraud-related chargebacks and raise the chance of successful representments with:

Handle dispute scenarios

Depending on the specific scenario, different procedures apply. However, all scenarios have certain things in common:

- Whenever a dispute case is initiated, we will inform you via e-mail. Make sure to reply to this e-mail as soon as possible, as all dispute scenarios require you to respond within a certain time frame. Find the deadlines for each scenario in the infoboxes at the end of each scenario description in this chapter.

- Your response should contain all relevant information about the impacted transaction. Use our template to know what we need. Consult our dedicated chapter to learn which information you can look up in the Merchant Portal and via our API.

- Respect specific deadlines for each scenario as mentioned in the individual chapters.

- Send the template and all other necessary information to us. Make sure to follow these guidelines:

- Write your answer in English or add an English translation.

- Submit all documents in converted to one PDF with a maximum of 10 pages.

- Apply a legible, professional look and feel.

- Use a structured and organised format.

- Ensure the best print quality of your documents.

- Avoid colourful pictures and print screens.

- We always send notifications to the address you have provided during your on-boarding (financial/administrative contact person). Contact us to change this e-mail address anytime

- Remember that e-mail addresses are configured per entity (TMID) and not by PSPID. Alternatively, we can send the notifications to specific e-mail address(es)

Check out the following individual chapters to learn the details about each possible scenario.

Retrieval request (request for information)

A retrieval request is initiated when an issuer requests information if a card holder does not recognise a transaction, suspecting fraud. Depending the information provided, the issuer decides whether to process a chargeback or not.

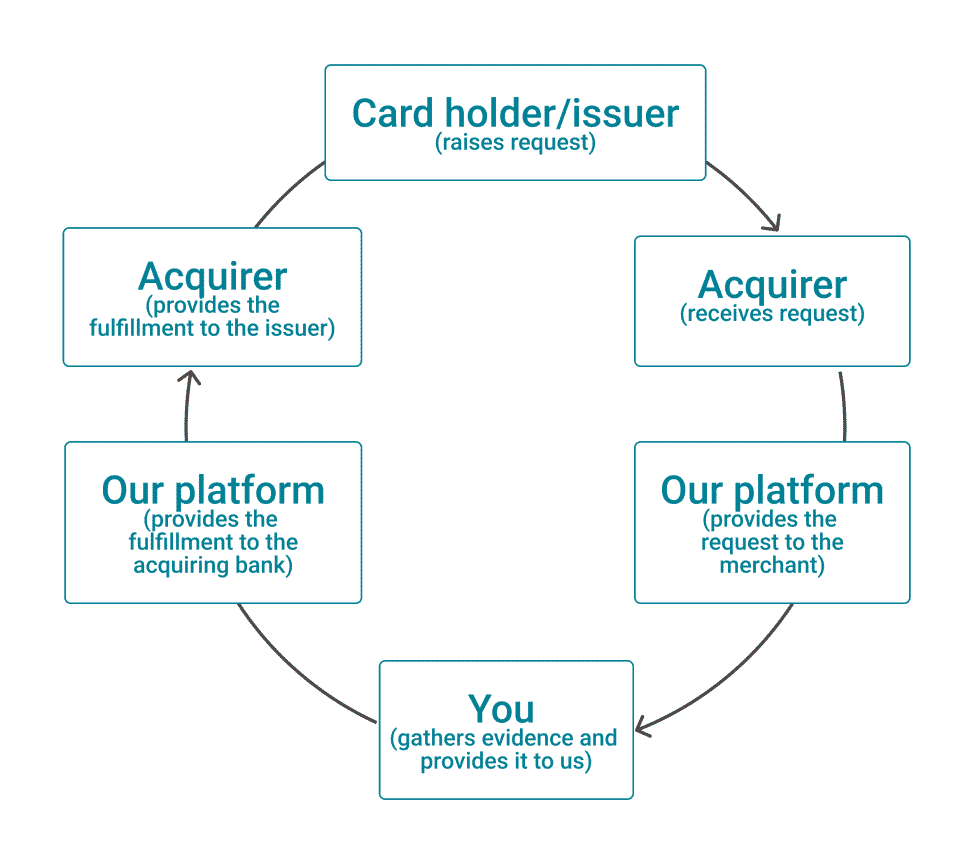

A retrieval request goes through different stages, impacting different parties:

Once the acquirer approaches us with the request, we inform you accordingly via e-mail. Find an example for such a notification here.

Your task is to provide evidence for assessing the suspected fraud case. To do so, follow these steps:

- Check the retrieval reason code in our notification, indicating the exact claim from the card holder. It will help you to gather the appropriate information for your response.

- Fill in the template using the Merchant Portal and our API to get the relevant information.

- Send the template and all other necessary information to us.

Eventually, the fraud cause is either dismissed or evolves into a notification of chargeback/chargeback case.

Alternatively, you can refund the transaction in question via either the Merchant Portal or our API. If you choose to do so, keep the following in mind:

- State in your response to us that you have or that you will perform the refund. Include the details of the refund in the template using the information available in the Merchant Portal. By doing this, you keep the representment right and the ability to recover the refund if the case evolves into a notification of chargeback/chargeback case.

- Perform the refund on the original transaction with the same payment method initially used. This way you prevent any party involved initiates an unjustified notification of chargeback/chargeback case because of missing information. To avoid or clarify misunderstandings, use the Acquiring Reference Number (ARN) in your communication. It is a unique tracking number you can find in the chargeback notification document, allowing you to prove you processed a refund. Use it to inform us that you have performed a refund.

- Make sure to answer to our notification within 14 calendar days. Missing the deadline can result in a notification of chargeback/chargeback.

- Remember that for acquirer BNP the acceptable time limit is only 5 calendar days.

Notification of chargeback

A notification of chargeback is initiated when your acquirer notifies you about an already processed or upcoming chargeback, granting you the chance to dispute it. Depending on the outcome of the dispute, the acquirer decides whether to reimburse the funds from you or not.

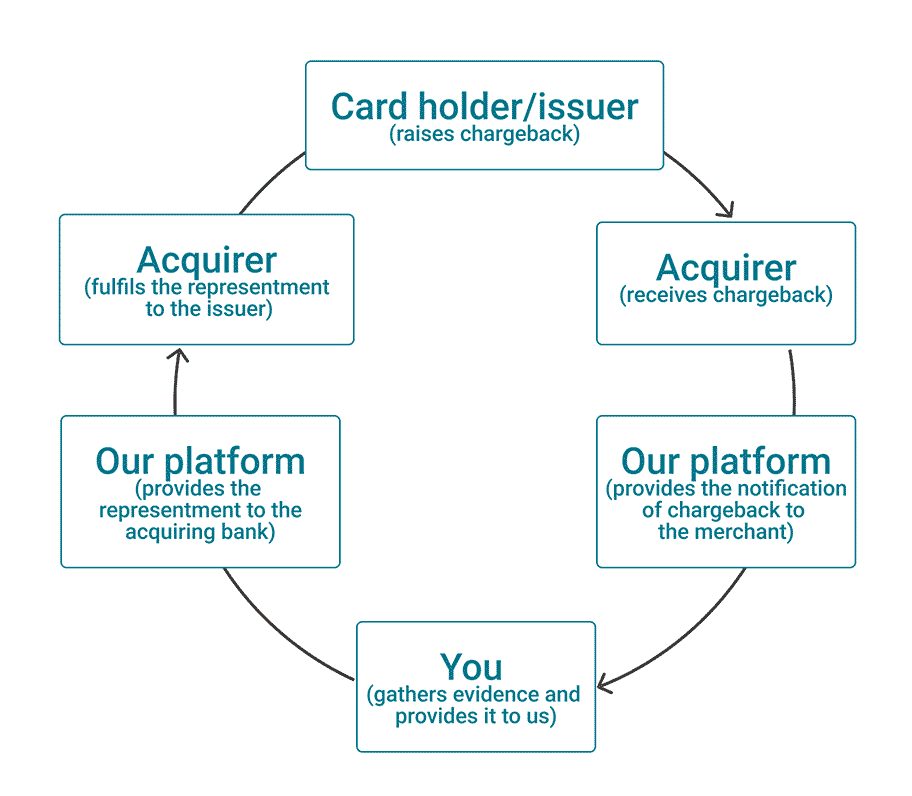

A notification of chargeback goes through different stages, impacting different parties:

Once the acquirer informs us about the chargeback, we inform you accordingly via e-mail. Find an example for such a notification here.

Your task is to provide information to dispute the (upcoming) chargeback. To do so, follow these steps:

- Check the chargeback reason code in our notification, indicating the exact reason why the acquirer processed the chargeback. It will help you to gather the appropriate evidence for disputing it.

- Fill in the template using the Merchant Portal and our API to get the relevant information.

- Send the template and all other necessary information to us.

Eventually, the case evolves either into a chargeback or a representment case.

- Do not refund the transaction upon receiving the notification, as you might run the risk of losing the funds twice and the representment right.

- Make sure to answer to our notification within 14 calendar days for MasterCard and 7 days for Visa transactions. Missing the deadline can result in losing the right for representment.

- There can be up 10 calendar days between receiving the notification and the reporting of the chargeback in the Merchant Portal. Therefore, we strongly recommend monitoring the transaction in question for up to 15 days after the notification of chargeback.

Chargeback

Your acquirer has processed a chargeback for a transaction the issuer/acquirer considers fraudulent, collecting the funds from you. You can reverse this chargeback by initiating a representment (chargeback reversal).

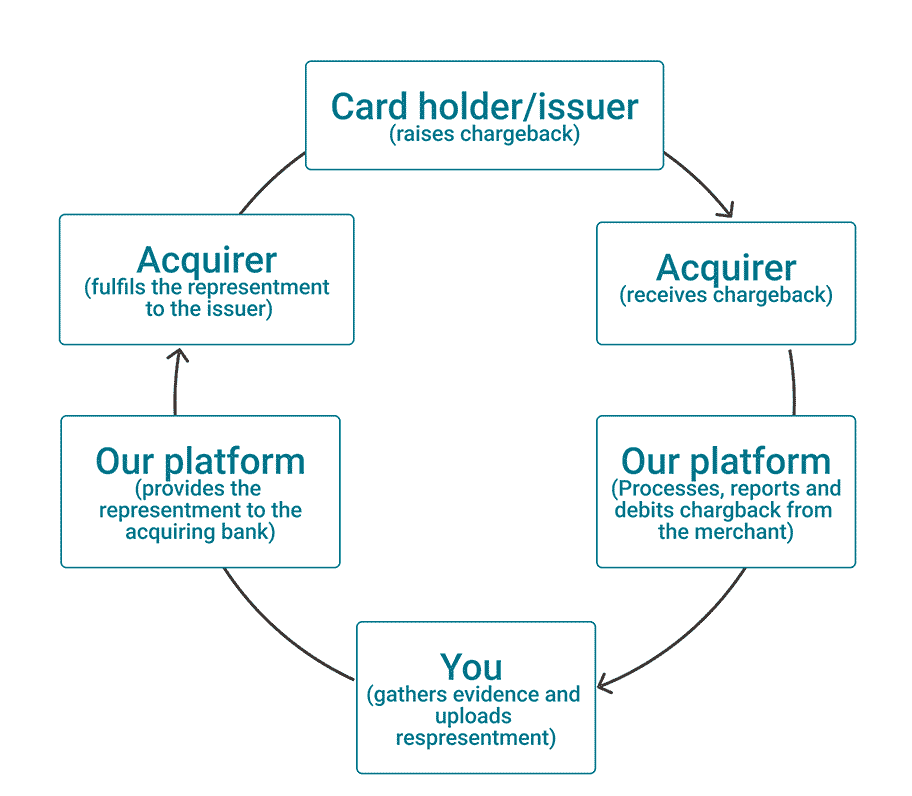

A chargeback goes through different stages, impacting different parties:

Once the acquirer processes the chargeback, we inform you accordingly via e-mail. Find an example for such a notification here.

Your task is to provide information to dispute the chargeback. To do so, follow these steps:

- Check the chargeback reason code in our notification, indicating the exact reason the acquirer processed the chargeback. It will help you to gather the appropriate evidence to dispute the chargeback.

- Fill in the template using the Merchant Portal and our API to get the relevant information.

- Upload the template and all other relevant documents in the payment console.

Eventually, three scenarios are possible

- The evidence is not enough to justify a representment. We deduct the transaction amount and a chargeback fee from the payout.

- The evidence is enough for a successful representment. We credit the transaction amount and the representment fee back to you, but not the chargeback fee.

- The evidence is enough to justify a representment, but is not successful, leading to a second chargeback case with new fees involved.

For the financial impact of a chargeback, the following timelines apply:

- The transaction amount will be usually within 10 calendar days after the chargeback notification. However, this might vary depending on the acquirer.

- The representment / dispute response depends on the card schemes:

- Mastercard: 2 days

- Visa: up to 30 days

Use our Merchant Portal to get a full overview on processed chargebacks (transactions with status 84):

- Go to Disputes.

- Filter the Disputes table by "Challenged" in column "Status".

- Do not refund the transaction up receiving the notification, as you might run the risk of losing the funds twice and the representment right.

- Make sure to answer to our notification within 14 calendar days for MasterCard and 7 days for Visa transactions. Missing the deadline can result in losing the right for representment.

- There can be up 10 calendar days between receiving the notification and the reporting of the chargeback in the Merchant Portal. Therefore, we strongly recommend monitoring the transaction in question for up to 15 days after the notification of chargeback.

- Card schemes monitor the number of chargebacks per merchant and might impose penalties if a certain threshold is exceeded. Therefore, avoiding chargebacks in the first place is the best way to deal with this kind of transactions. We offer tools that can significantly reduce the impact of fraud.

Representment

You try to reverse a chargeback by gathering evidence, proving that either the acquirer or issuer is liable. Depending on the outcome, you the chargeback is reversed.

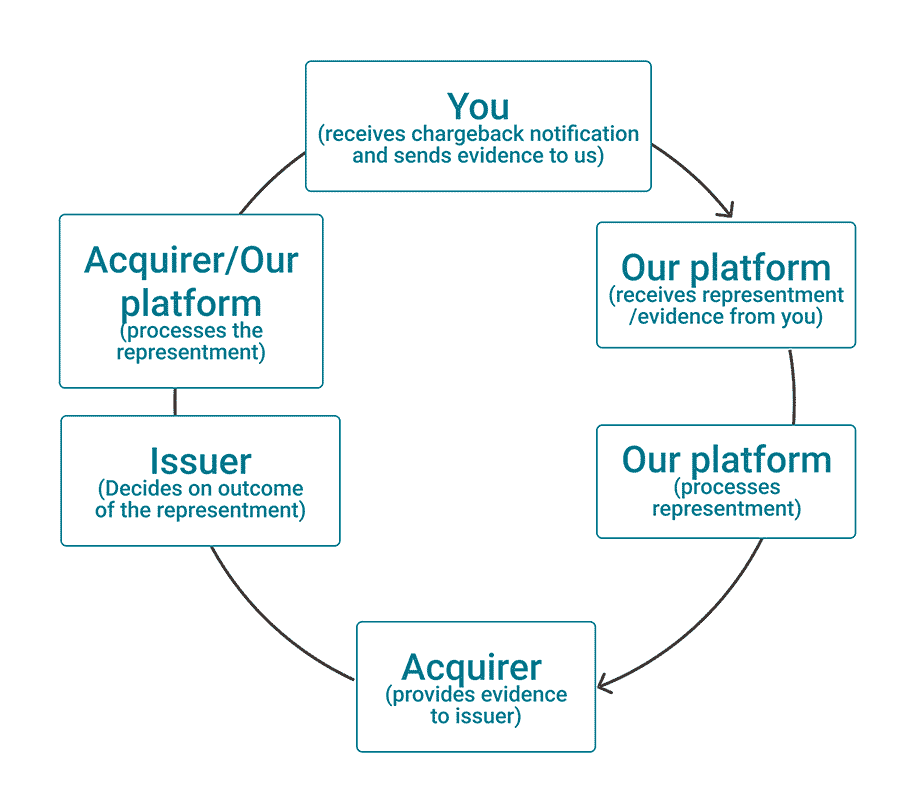

A representment goes through different stages, impacting different parties:

As soon as we have informed you about the chargeback(Find an example for such a notification here), you can initiate a representment.

Your task is to provide information to dispute the initial chargeback. To do so, follow these steps:

- Check the chargeback reason code in our notification, indicating the exact reason the acquirer processed the chargeback. It will help you to gather the appropriate evidence to dispute the chargeback.

- Fill in the template using the Merchant Portal and our API to get the relevant information.

- Send the template and all other necessary information to us.

Eventually, two scenarios are possible

- The evidence is enough for a successful representment. We credit the transaction amount and the representment fee back to you, but not the chargeback fee.

- The evidence is not enough for a successful representment, leading to a second chargeback case with new fees involved.

Use our Merchant Portal to get a full overview on processed chargebacks (transactions with status 94):

- Go to Disputes.

- Filter the Disputes table by "Defending" in column "Status".

- If you have received a request for information prior to the chargeback, you must present new evidence to give the case a chance for a successful outcome. Issuers will only consider a liability shift in your favour if presented with new evidence.

- Make sure to answer to our notification within 14 calendar days for MasterCard and 7 days for Visa transactions. Missing the deadline can result in losing the right for representment.

- There can be up 60 calendar days between submitting the representment and the outcome. If we have not received any feedback from the issuer/acquirer after this period, the case will automatically expirer, leading to a lost representment.

- By card scheme regulations, cardholders have the right to challenge a chargeback. This might end up in a second chargeback claim or a (pre)arbitration case.

- We apply an auto-representment service as part of our dispute management tool. With our historically high success rate, we ease dealing with disputes even further for you:

- Using the information in the Merchant Portal, our platform initiates representment automatically – with no input from you required!

- To avoid double losses, we challenge chargebacks if you have already processed a refund for impacted transactions.

Nevertheless, we still strongly recommend monitoring and dealing with chargebacks on your own!

Handle exceptional dispute scenarios

In some cases, the established dispute handling processes are not sufficient to settle a case. To solve cases like these, there are specific procedures involving the card schemes as an arbitrator.

(Pre-) Arbitration chargeback

Sometimes a first chargeback and subsequent representment does not settle a dispute between your acquirer and your customer’s issuer. Consequentially, either party can file an arbitration case with the impacted card scheme to reach a final ruling.

Issuers will only file an arbitration case if they are confident to win it. Card schemes do not encourage arbitration cases due to the effort involved. Therefore, they impose high fees:

- Mastercard:

150 USD/EUR filing fee

250 USD/EUR administration

for the party losing the case100 USD/EUR technical fee per violation against any member found to have been in violation of the dispute processing rules (i.e. persisting with an invalid chargeback/submitting an invalid second presentment)

-

Visa:

250 USD or 270 EUR filing fee

250 USD or 270 EUR review feefor the party losing the case

Therefore, you need to balance the reasons to engage in a case like this

Typically, an issuer will inform you about the initialisation of the arbitration chargeback. If you choose to challenge this chargeback, your task is to provide new evidence from what you provided during the representment. To do so, follow these steps:

- Contact our Dispute Management team to inform them about the ongoing case. They will give you an assessment of the chances of success

- In case of a positive assessment, fill in the template using the Merchant Portal and our API to get the relevant information

- Send the template and all other necessary information to us

(Pre-) Compliance chargeback

This procedure allows a party that has no chargeback right to file a complaint against another party for violating the card scheme regulations. The complaining party files a case with the impacted card scheme to reach a final ruling.

Before initiating the case, the complaining party must attempt to settle the case via a pre-compliancy procedure with the opposing party.

Issuers will only file an arbitration case if they are confident to win it. Card schemes do not encourage arbitration cases due to the effort involved. Therefore, they impose high fees:

- Mastercard:

150 USD/EUR filing fee

250 USD/EUR administration

for the party losing the case - Visa:

250 USD or 270 EUR filing fee

250 USD or 270 EUR review fee

for the party losing the case

Therefore, you need to balance the reasons to engage in a case like this

We will always inform you if we iniate a (pre-) compliance chargeback. When providing us with information for this case, treat it like a regular chargeback case.

Good faith request

If all the described procedures fail to defend your business interests, we offer this special service as a last resort.

If you consider a second chargeback unjustified because of extraordinary circumstances, contact us. We will use our well-established relationships with acquirers to try reverting this chargeback in your favour. If the acquirer accepts to pick up this case, it will renegotiate with the issuer. However, after 30 days with a negative response or none, the acquirer will close this matter as a lost case.

As this is not an official procedure, neither party (acquirer/issuer) involved is obliged to respond to a good faith request.

Get information for responses

Providing as many relevant information as possible is key to protect you from fraudulent transactions.

To help you with this, fill in the template you send back in your response. Consult this list to learn where to find the transaction-related bits in the Merchant Portal and our API to get the relevant information:

| Information | To be found via |

|---|---|

| Transaction date |

Merchant Portal (field "Authorization Date") |

| Transaction amount and currency |

Merchant Portal (field "Amount") |

| Truncated card number |

Merchant Portal (field "Amount") |

| AVS (Adress Verification Service) |

Value returned in GetPaymentApi/GetPaymentDetails paymentOutput.cardPaymentMethodSpecifcOutput.fraudResults.avsResult |

| 3D Secure authentication If authentication took place, provide the ECI code |

Value returned in GetPaymentApi/GetPaymentDetails paymentOutput.cardPaymentMethodSpecifcOutput.threeDSecureResults.eci Read our dedicated guide to learn more about 3-D Secure and ECI values. |

| Cardholder name |

Merchant Portal (field "Cardholder Name") |

| Cardholder address and billing address |

Value sent in CreatePayment order.customer.billingAddress |

| Cardholder phone number |

Value sent in CreatePayment order.customer.billingAddress |

| Cardholder email-address |

Value sent in CreatePayment order.customer.contactDetails |

| Cardholder date of birth |

Value sent in CreatePayment order.customer.contactDetails.personalInformation |