Multibanco

Intro

- Payment location (ATM of Multibanco network)

- Payment reference

- Amount

- Payment period (start and end date)

Integration

Redirect your customers to the Thunes payment portal via our Hosted Checkout Page. Find a high level overview in the "Process flows" chapter.

Add the following properties to a standard CreateHostedCheckout request:

{

"order": {

"amountOfMoney": {

"currencyCode": "EUR",

"amount": 10000

},

"customer": {

"contactDetails": {

"emailAddress": "jean.dupont@test.com"

}

},

"references": {

"merchantReference": "mr_{{TIMESTAMP}}"

}

},

"hostedCheckoutSpecificInput": {

"locale": "pt_PT"

},

"redirectPaymentMethodSpecificInput": {

"paymentProductId": 5500

}

}

| Properties | Remarks |

|---|---|

|

order.customer.contactDetails.emailAddress |

Your customer’s e-mail address. |

|

redirectPaymentMethodSpecificInput.paymentProductId |

The numeric identifier of the payment method on our platform. Find this id in the "Overview" chapter. It instructs our platform to send your customers directly to the Thunes portal. If left out, our platform sends your customers to the Hosted Checkout Page instead, allowing them to choose this or any other payment method in your account. |

Find detailed information about this object and its properties in our CreateHostedCheckoutAPI.

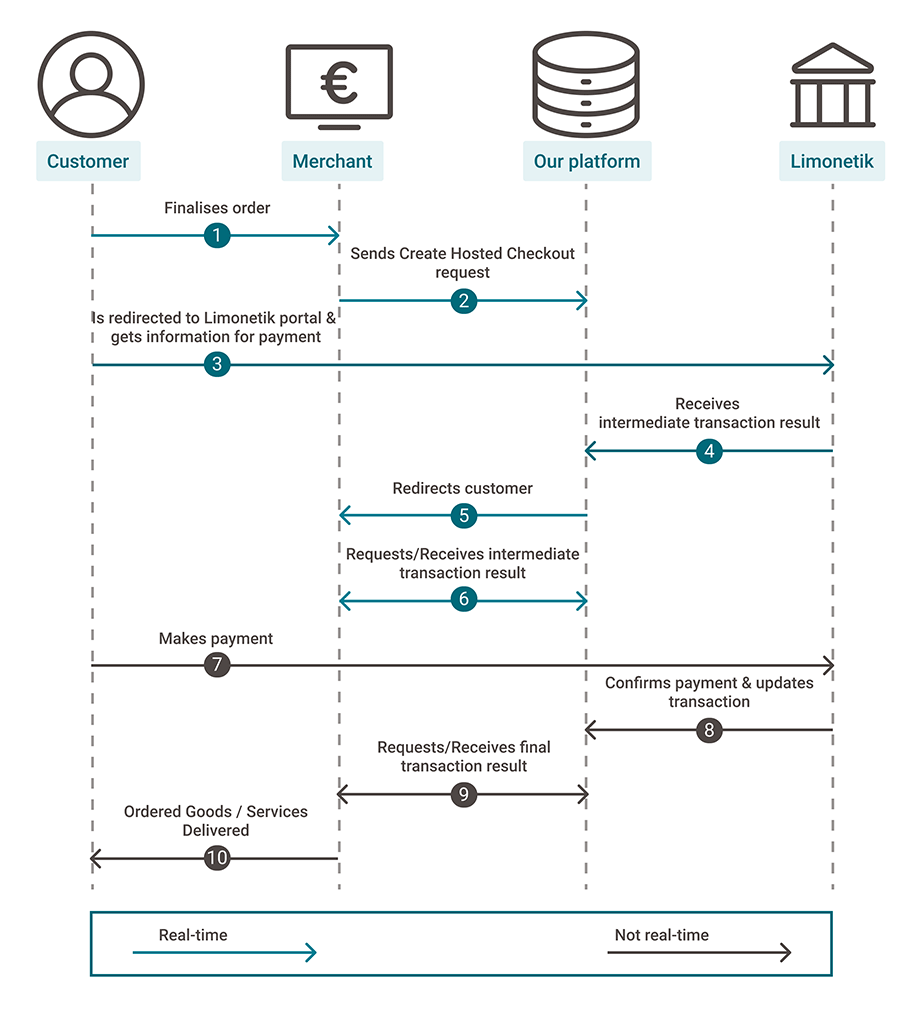

Process flows

- Your customers finalise an order in your shop and select Multibanco.

- You send this CreateHostedCheckout request to our platform.

- You redirect your customers to the Thunes portal via the redirectUrl. It provides all necessary information to your customers to make the actual payment at a later point (step 6).

- We receive the intermediate transaction result (statusOutput.statusCode=51)

- We redirect your customer to your returnUrl

- You request the intermediate transaction result (statusOutput.statusCode=51) from our platform via GetPayment or receive the result via webhooks.

- Within the predefined period, your customers make the actual payment at an ATM of Multibanco network by either credit card or cash.

- Multibanco confirms the receipt of payment to us. We update the transaction to statusOutput.statusCode=5

- You request the final transaction result (statusOutput.statusCode=5) from our platform via GetPayment or receive the result via webhooks.

- If the transaction was successful, you can deliver the goods / services.

- The predefined payment period is 2 – 3 days. You can adapt the duration by consulting Thunes.

- Only send the goods/services after we have updated the transaction to StatusCode=5. Use our webhooks or a GetPayment request to get the current status in realtime.

- If Multibanco does not confirm the receipt of payment within the predefined period, we update the transaction to StatusCode=2

Testing

Refer to our Test cases for test data and detailed instructions.

Make sure to use the right endpoint and switch back to the live URL as soon as you have finished your tests.